Your 1099 and taxes FAQs

We receive quite a few questions regarding the 1099 Tax Form. In order to provide more clarity about the confusing world that is tax returns, we’ve put together an example and compiled answers to some commonly asked questions.

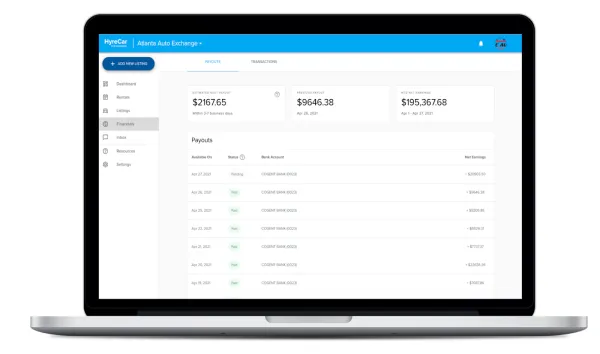

Q: “Why is the 1099-MISC amount different from the amount shown on my HyreCar dashboard?”

A: The 1099-MISC amount is the total transaction value drivers paid to rent your car (including HyreCar’s fee and insurance costs). The amount shown on your HyreCar Dashboard is net of HyreCar’s fee and driver insurance costs.

For example, if a driver rents your car for the offer price of $200 per week. The total cost to the driver is $290 ($70 for insurance and $50 HyreCar fee). Your 1099-MISC will show $290 and your dashboard will show $170. The difference between the total listed on your form 1099-Misc and your dashboard consists of fees and insurance which may be considered Operating Expenses and itemized on your 2016 Tax Return.*

Q: “Why does my HyreCar dashboard payment total differ from the amount I received in my bank account?”

A: Your dashboard is simply a list of your past rentals. It does not include ancillary payments (tickets, tolls, excess mileage, insurance claims, manual rental transactions, etc). These ancillary payments may be itemized as Operating Expenses on your Tax Return.*

Thanks again for renting your vehicle! Feel free to contact us with any further questions.

*Disclaimer: HyreCar does not provide tax filing service, please consult with a tax professional for personalized filing and tax information.